Property Edge

The 3 Things You Need to Know About This Property Market

Welcome to this month’s edition of Property Edge, where we bring clarity and insight to the complex dynamics of Australia’s real estate sector. Amid rising property prices and ongoing debates about housing supply, this issue presents three critical insights that every property investor, developer, and market watcher should understand. Dive into an in-depth analysis of what’s driving property values, the surge in the YIMBY movement, and some potential solutions to the housing affordability crisis.

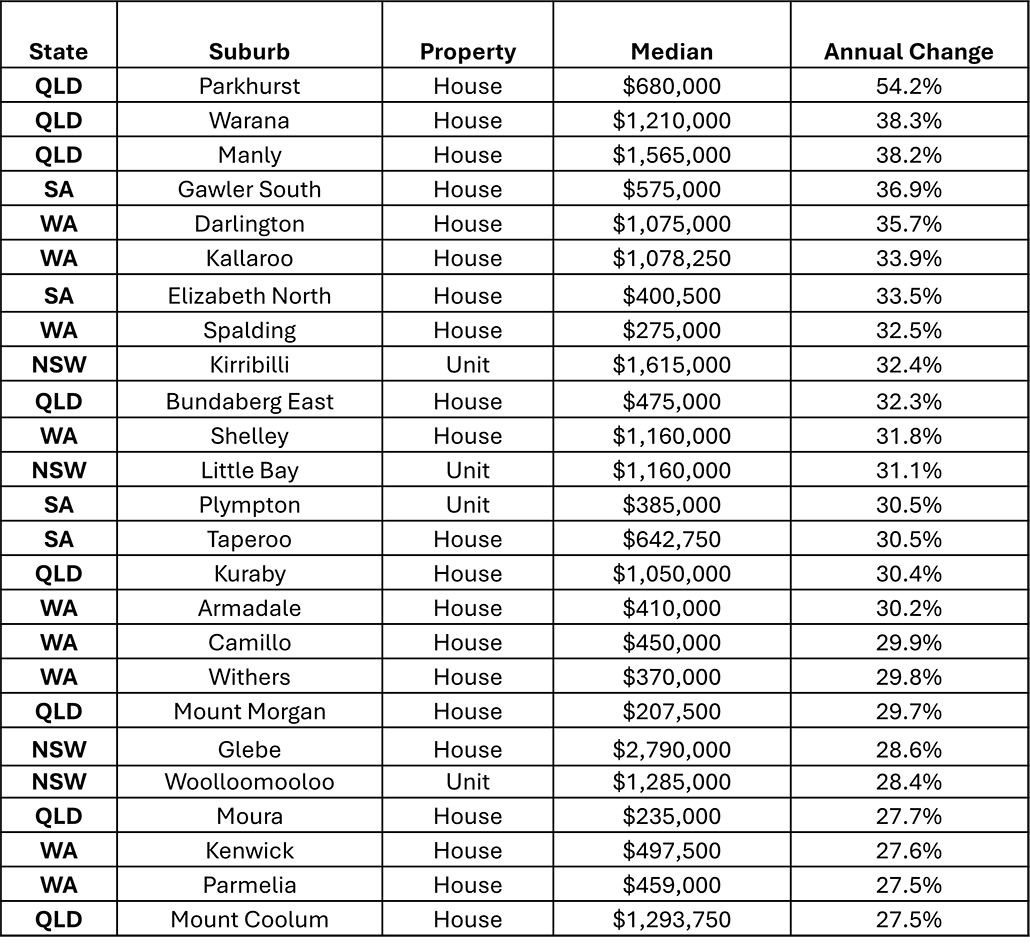

Australia’s Top 25 Performing Suburbs for Annual Growth Revealed

Recent findings from the latest Domain House Price Report have highlighted the top 25 performing suburbs in Australia, showcasing significant property price growth across diverse regions—from rural Queensland locales to the inner suburbs of Sydney.

This year’s list sees a mix of lesser-known ‘bridesmaid’ suburbs making a mark due to increased buyer interest and consequent price surges. Among them are Parkhurst in Rockhampton, Queensland, Warana on Queensland’s Sunshine Coast, and Darlington in Perth, each experiencing significant median-price increases.

Dr. Nicola Powell, Domain’s Chief of Research and Economics, describes this as a natural dynamic of the housing market, noting a ripple effect that often starts in premium suburbs and spreads to more cost-effective areas as prices rise. This movement, she explains, typically pushes buyers to adjacent, less costly areas, driving up demand and prices there.

Suburbs like Warana have surged in visibility and desirability post-pandemic, with significant development activities such as new duplexes and renovations enhancing their appeal. Parkhurst in Rockhampton, noted for its 54.2% growth, is now seen as a growth corridor, benefiting from new family-friendly estate developments.

As the market evolves, these trends underscore the importance of regional diversity and the myriad of opportunities for profit within Australia’s property market.

Buying a Home with Cash: Insights into Top Suburbs and Pricing Trends

Recent Australian property market data has revealed that a significant number of home buyers are opting to purchase properties outright without the need for mortgages. According to the latest research from property settlements platform PEXA, certain affluent suburbs have seen a sharp increase in cash transactions, revealing buyer trends and regional hotspots where cash is king.

Key Findings:

High-value Cash Transactions:

Dominant Suburbs for Cash Purchases:

Sydney: Darling Point and Milsons Point are notable, with median cash purchases at 3.35M and 2.5M. Here, at least 60% of property transactions were conducted in cash.

Melbourne: Exclusive suburbs like Toorak and Brighton saw median cash purchases at 2.3M and 2.018M respectively. Carlton and Melbourne CBD attracted cash-rich investors, albeit at lower median prices of 235,000 and 603,500, respectively, which was likely due to smaller investment properties aimed at the student rental market.

Brisbane: New Farm topped the Brisbane market with cash purchases averaging 1.3M.

Market Dynamics:

The trend of buying properties without a mortgage is much higher in downsizer-friendly and investor-heavy suburbs. With over one in four property transactions last year settled without a mortgage, there’s a clear shift towards more liquidity in real estate investments. This trend is fuelled by the following factors:

Demographic Shifts: Older, wealthier populations in these suburbs often have significant capital from previous home sales or other investments, allowing them to purchase without financing.

Economic Factors: As interest rates rise, reducing borrowing capacity, cash buyers—who are typically less affected by rate changes—find themselves in a stronger position to secure real estate directly.

Implications for Buyers and Investors:

This shift underscores the importance of understanding regional trends and the financial dynamics at play in preferred suburbs. So, the key takeaways from these insights for Property Lovers are:

Strategic Play: Recognising that suburbs with high cash transaction rates can indicate areas with strong investor confidence and financial stability. If you are looking to negotiate flexible terms you may have a low success return on investment for your time and energy in crafting offers as you are competing with cash buyers who won’t bat an eye and playing in an area where money talks! Conversely, high mortgage belt suburbs may have more opportunity for creative offers and provide more avenues to create value in your negotiations.

Investment Opportunities: Areas with lower median cash purchase prices, like Carlton and Melbourne CBD, may offer unique opportunities for investors looking to cater to specific markets such as student accommodations.

This analysis not only highlights the significant role of cash transactions in shaping the property landscape but also aids buyers in making informed decisions based on current market conditions. Whether you’re a seasoned investor or a first-time buyer, understanding where and how properties are bought with cash can provide a competitive edge in your property dealings – even if it is knowing where not to focus if the buyer competition is too strong.

Rising Property Prices and the YIMBY Movement Gain Momentum Amid Housing Supply Crunch

Recent data from CoreLogic highlights an ongoing climb in Australian property prices, caused by a significant lack of housing supply, coupled with strong demand. As of April 2024, the national median property price reached 779,817, marking a 0.6 percent increase. This uptick in prices continues against a backdrop of economic challenges, including low consumer sentiment and high interest rates, and yet persistent demand continuing to outpace the available property supply.

Key Insights:

Continuous Price Increases: Property values have risen for 15 consecutive months, with Sydney maintaining a median property value above 1 Mil, the highest among capital cities.

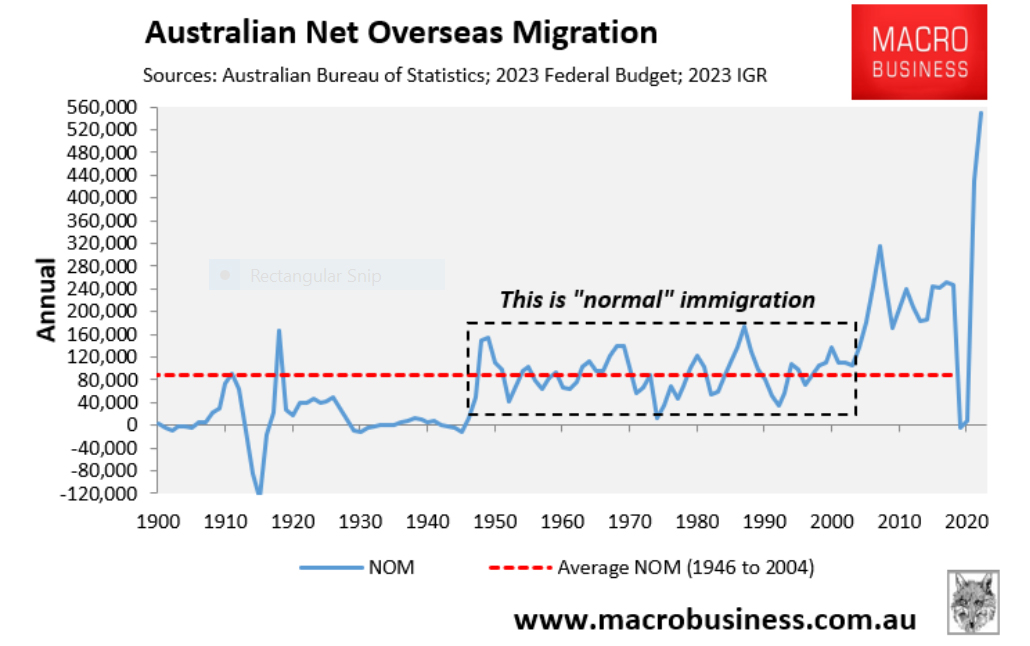

Rental Market Trends: Rental costs are also on the rise, rising by 0.8 percent in April, primarily driven by increased overseas migration in the past two years.

The YIMBY Movement:

In response to the affordability crisis, the ‘Yes In My Back Yard’ (YIMBY) movement is gaining traction, advocating for more development, particularly medium and high-density housing, to alleviate the shortage. The movement aims to counteract the ‘Not In My Back Yard’ (NIMBY) sentiment that often opposes new developments. Proponents of YIMBY argue for the necessity of building more housing units close to city centres to ensure affordability and accessibility.

Demographic Divide:

The housing crisis has exacerbated a divide between older homeowners and younger individuals struggling with high housing costs. The lack of affordable housing options is forcing younger demographics and essential workers out of major cities, contributing to a functional and demographic shift within urban areas.

Proposed Developments:

Examples of developments sparking debate include a project in the Sydney suburb of Neutral Bay, where plans to rebuild a supermarket into an apartment complex highlight the kind of medium-density development YIMBY supporters want to see more of. However, these proposals often meet with strong resistance from local residents concerned about the impact on community character and infrastructure.

Expert Perspectives:

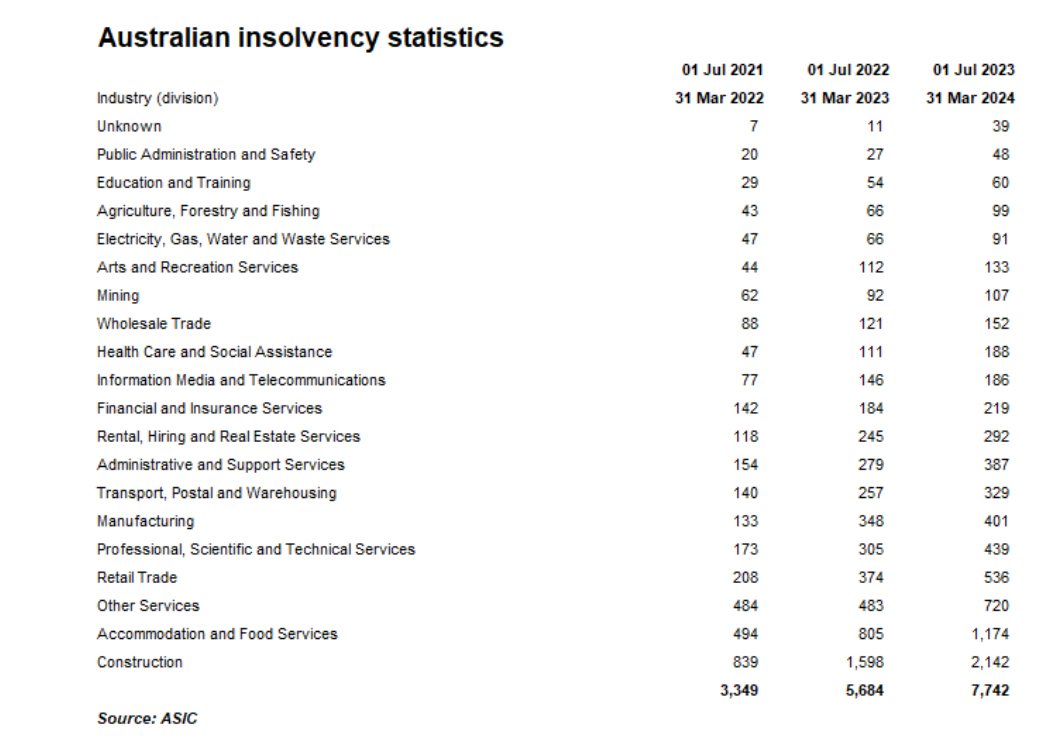

Cameron Kusher, PropTrack Economist, emphasises that while increasing housing supply is crucial, addressing housing affordability requires broader measures, including tax reforms. Suggestions include removing stamp duty to encourage mobility within the housing market and incorporating the family home in the pension asset test to incentivise downsizing among retirees. Add to this an overlay of a huge uptick in migration as well as hyperinflation impacting the building and construction industry and you have a powder keg about to blow.

We have now unprecedented migration due to policies relaxed to fill a labour shortage amongst other things

This has put pressure on housing supply which has led to a rental crisis however the industry needed to ease the pent up demand is collapsing under soaring costs which render construction economically unviable.

Infrastructure and Community Concerns:

Both supporters and opponents of increased density agree that infrastructure enhancements are necessary to accommodate population growth. Effective planning must ensure that schools, public transport, and other community facilities keep pace with housing development.

The debate over how to best manage and develop housing to combat the affordability crisis continues to evolve. While the YIMBY movement advocates for increased housing density, it would see that a multi-faceted solution may be required to incorporate comprehensive policy adjustments that address both supply and demographic dynamics.

Thank you for exploring the key factors shaping Australia’s property market with us. As we witness significant transformations in housing dynamics, staying informed is crucial for making savvy decisions. Look forward to our next edition, where we will continue to deliver essential market insights and forward-thinking strategies.

NEW EVENT ALERT: We are running a special ONLINE livestream called ‘The Property Challenge’ on Saturday, 25th May from 9am to 1pm (AEST).

On This Livestream, We Will Show You How You Can Potentially Make 100K In The Next 3 Months And 250K In 12 Months Doing No Money Down Deals Buying Wholesale Properties With The Help Of AI From Distressed Property, Deceased Estates, Developers Under Duress, And Downsizers.

Limited seats! Register now for FREE! Click here for the details.