Property Edge

Builder Insolvencies Threaten Government’s Housing Target

Welcome to this week’s edition of Property Edge, where we delve into the current state of the property market through the lens of seven insightful graphs. These visual representations will provide you with a comprehensive understanding of the trends and dynamics shaping the real estate landscape in Australia. From immigration’s impact on supply and demand to the influence of interest rates on property prices, we’ve got you covered with data-driven insights.

Builder Insolvencies Threaten Government’s Housing Target

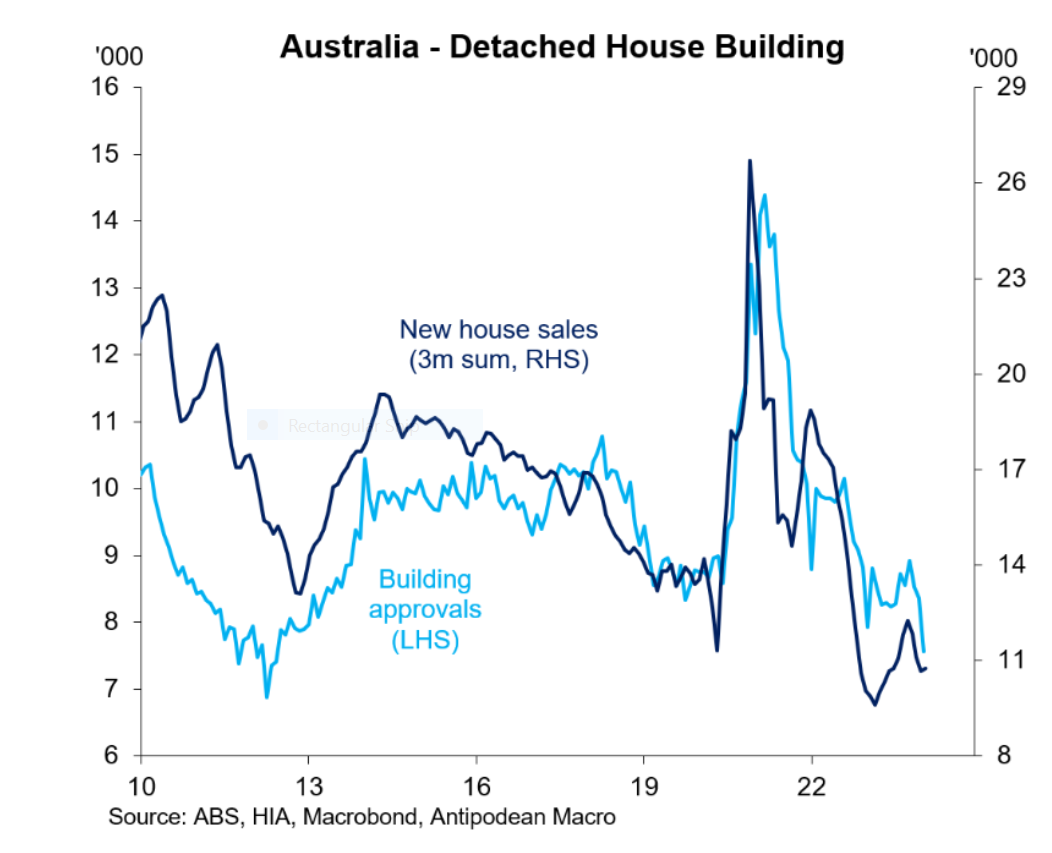

Australia’s ambitious goal to construct 240,000 homes annually for five consecutive years is facing a significant setback due to a surge in builder insolvencies. Data up to January 2024 indicates that only 163,000 homes have been approved for construction, falling well short of the target by 77,000 homes.

The downturn in construction activity can be attributed to several factors:

High Interest Rates: Rising interest rates have cooled buyer demand and made financing more challenging for development projects.

Labour Shortages: The construction industry is grappling with a lack of workers, partly due to competition from state government infrastructure projects.

Increased Material Costs: The pandemic has led to a surge in materials costs, eroding profits for home builders and driving many into insolvency.

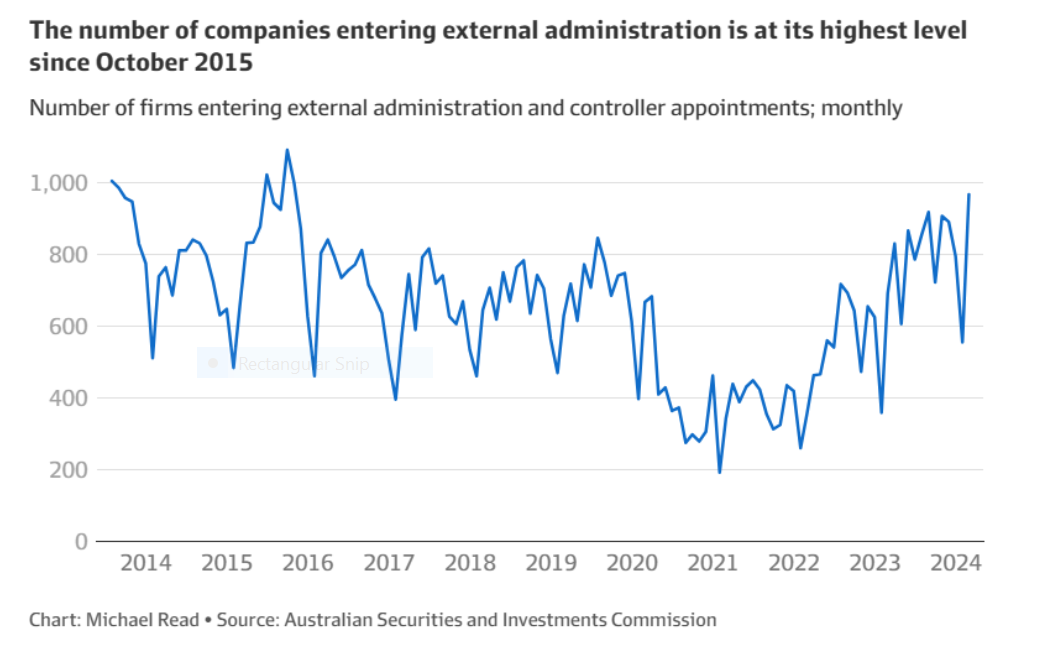

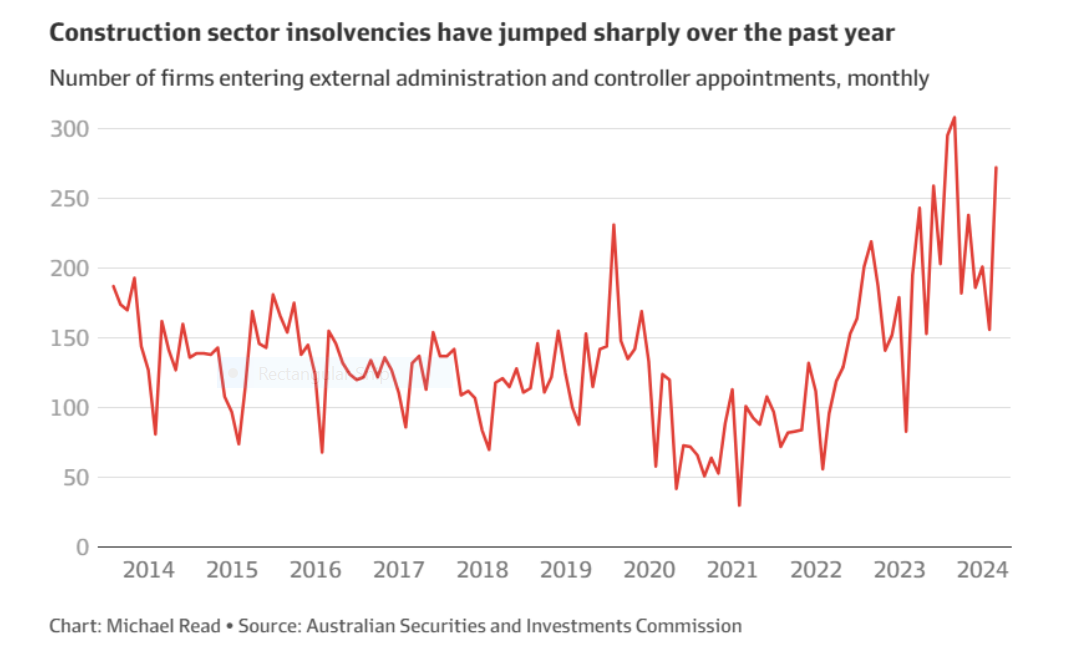

Recent data from the Australian Securities and Investments Commission (ASIC) reveals that corporate insolvencies reached their highest level since 2015 in February, with 967 companies entering administration, a 40% increase from the previous year. The construction sector has been hit hardest, with 270 firms going under in February 2024, nearly triple the number from February 2022.

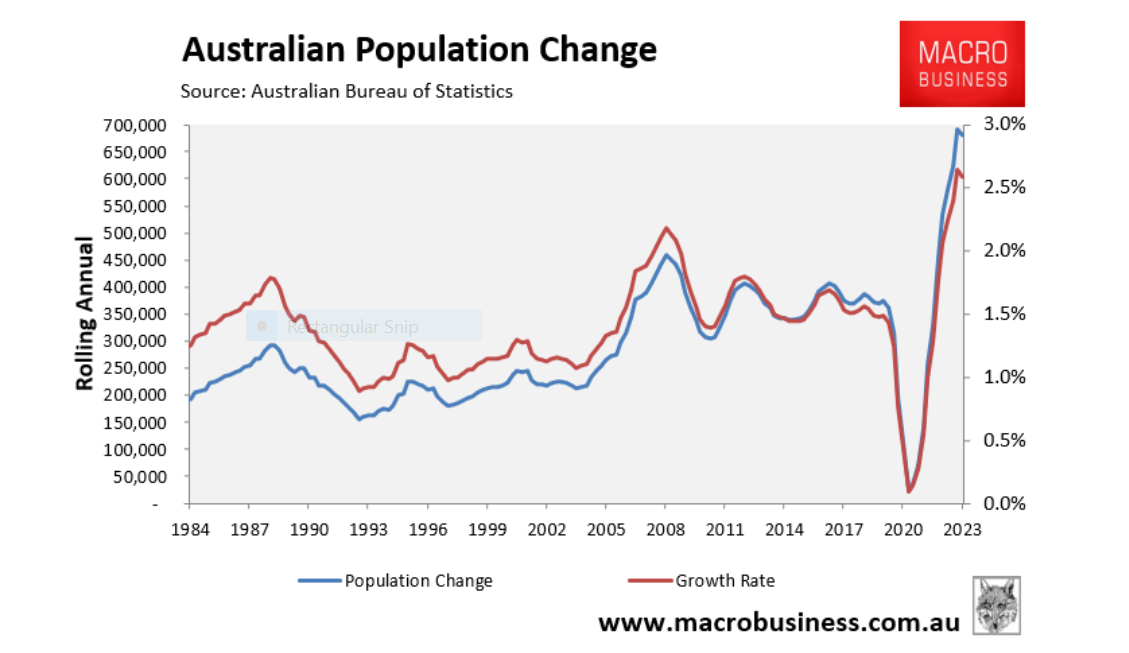

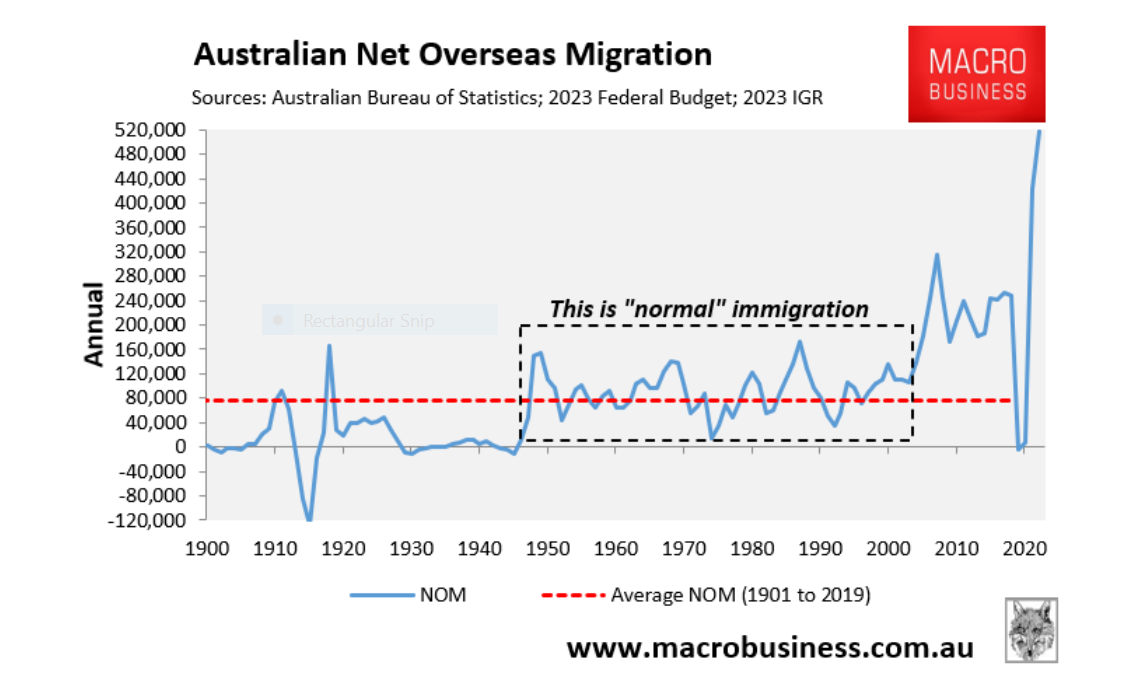

Compounding the issue is Australia’s rapid population growth, which added 680,000 new residents in 2023. With housing construction rates declining while the population expands at an unprecedented rate, the country is on the brink of a severe housing crisis.

To avert this looming disaster, there are calls for a drastic reduction in net overseas migration, as the current pace of growth is unsustainable without a corresponding increase in housing supply.

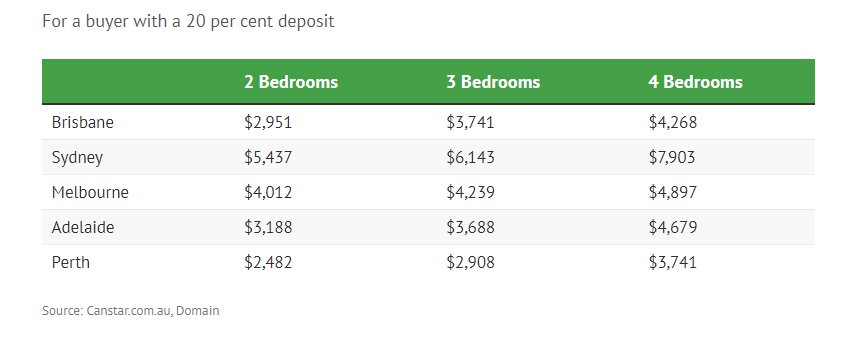

Profitable Opportunities for Renovators: Adding Bedrooms to Capitalise on Price Disparities

Canstar data published this week revealed the cost for home buyers in terms of interest repayments on borrowings to acquire a larger house with more bedrooms. The published figures clearly show that in Australia’s major cities, the price gap between three-bedroom and four-bedroom homes is not insignificant which presents a lucrative opportunity for renovators. In Sydney, the difference in mortgage repayments can amount to an additional $1,760 per month, while in Melbourne, Brisbane, and Perth, the disparities are $658, $527, and $833, respectively. This price gap between three and four bedroom homes highlights the potential for profit by adding an extra bedroom to a property. With the cost-of-living crisis pushing families to seek more affordable options, renovators can capitalise on this trend by transforming smaller homes into more spacious dwellings. While interest rate cuts are anticipated, they may not arrive soon, keeping the demand for larger homes high. As property prices continue to rise, especially with potential interest rate reductions on the horizon, renovators have a unique opportunity to increase the value of properties and attract buyers looking for additional space. This market dynamic presents a strategic avenue for investors and renovators to generate substantial returns by catering to the growing demand for larger family homes.

Mortgage Repayments When Adding an Extra Bedroom

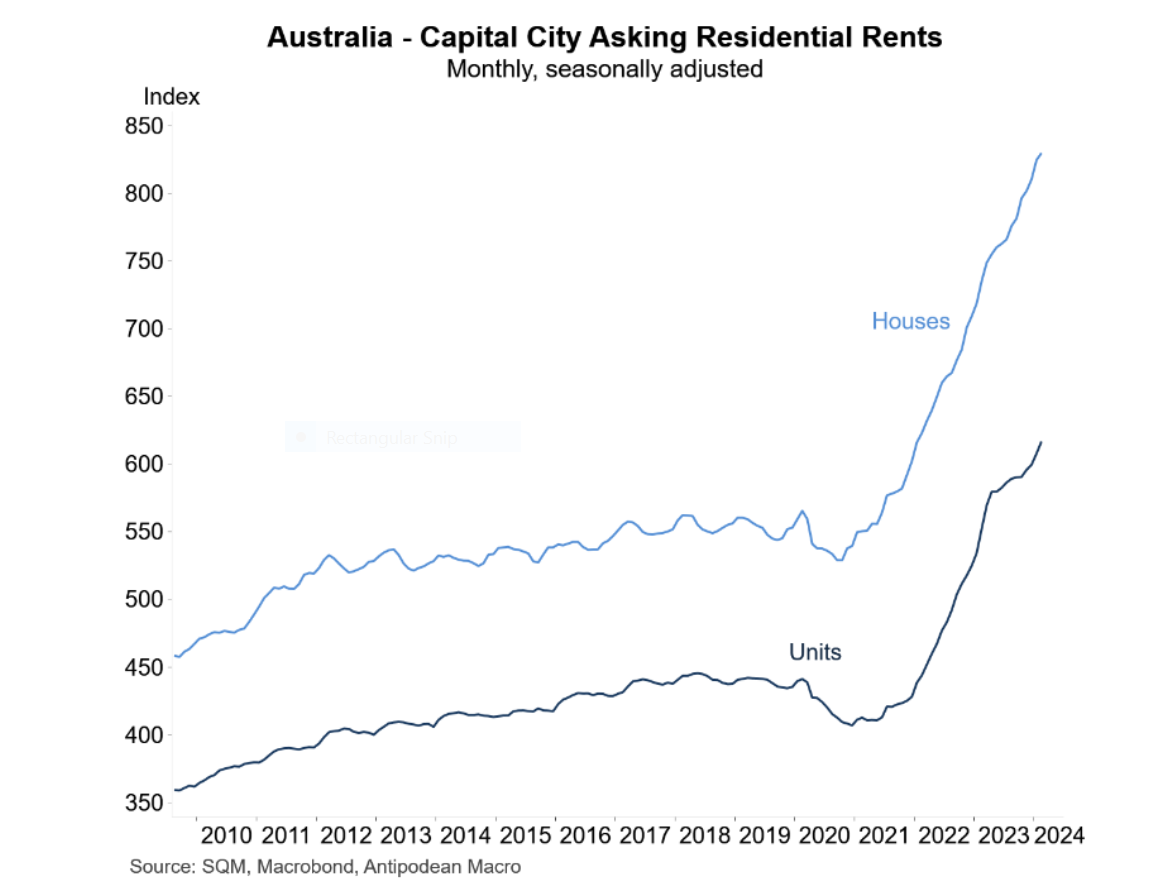

Australia’s “astonishing” population surge is set to push property prices and rents even higher, despite a surprise fall in unemployment. The country’s population has reached 26.8 million, with net overseas migration contributing to 83% of the annual growth. Western Australia, Victoria, and Queensland are experiencing the fastest growth rates, exacerbating the housing market’s stress. The increase in population, combined with a 0.4% drop in the unemployment rate to 3.7%, could pressure interest rates and further fuel property price gains in 2024. Despite potential interest rate challenges, the overwhelming population growth is likely to drive continued demand for housing, resulting in price and rent increases across most capital cities.

Reserve Bank of Australia Governor Michele Bullock highlighted in a press conference this week that aggregate demand has exceeded supply, particularly in services and housing, leading to elevated inflation rates. Despite slowing GDP growth, the demand for housing remains higher than supply, driven by population growth through net overseas migration. This imbalance has resulted in soaring rents and house prices, prompting the RBA to maintain higher interest rates to combat inflation. As the economy adjusts, with demand slowing and coming more in line with supply, the RBA’s monetary policy will continue to play a crucial role in stabilising the market.

We can see the vertical lines on these two graphs painting a very clear picture in relation to the impacts of a fast-growing population on an already tight housing supply.

Thank you for joining us in this graphical journey through the property market. We hope these seven graphs have provided you with a clearer picture of the forces at play in the real estate sector. As always, our goal is to keep you informed and equipped with the knowledge you need to navigate the ever-evolving property landscape. Stay tuned for more updates and insights in our next edition of Property Edge.

NEW EVENT ALERT: We are running a special ONLINE livestream called ‘The Property Challenge’ tomorrow, Saturday, 23 March from 9am to 1pm (AEDT).

This is our big claim “Give Us Just Half A Day And We Will Show You The Exact “Step By Step” Method To Find And Flip Properties For Cash Profits In The Current Market For Little To No Money Down From Distressed Property, Deceased Estates, Developers under Duress, and Downsizers”.

Limited seats! Register now for FREE! Click here for the details.