Saturday, 18th Nov 2023 9:00am to 10:30am (AEDT)

Register Free NowWant to know how our students are profiting to the tune of multiple 6 figures right now acquiring undervalued distressed properties without finance, any of their own money or even without paying stamp duty or CGT?

At this timely Distressed Property Masterclass , we’ll show you how this is possible.

In February 2022, RBA told us not to worry and interest rates would not move but less than three months later they started raising rates in huge, unprecedented leaps in order to combat runaway inflation.

The problem is global and inescapable. Australia’s latest inflation figures for the June quarter show 7.3% annual inflation – a jump not seen since GST was introduced in 2000.

Reserve Bank has lifted interest rates for the thirteenth time in a row, increasing the cash rate by 0.25 percentage points to 4.1 percent with more increases expected.

This means that we all have less money left over at the end of the week after paying for petrol, groceries and higher mortgage repayments.

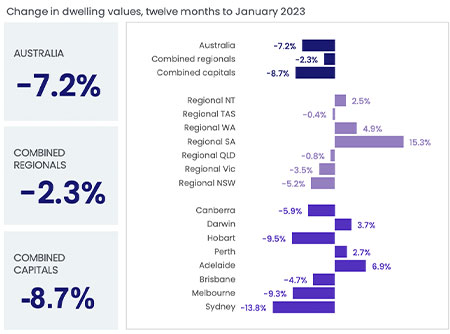

This environment has caused house prices to start to tumble

A lot of people are in for a lot of pain – many are up to their eyeballs in debt having chased a runaway property market bubble when rates were low, and it was promised they would stay there.

But it’s also a huge opportunity for you because, at the upcoming Distressed Property Masterclass 2024, you’ll discover how to find mortgage-stressed homeowners and motivated sellers in this perfect storm of a market…

… and then help them out of a tight spot while also potentially securing properties at anywhere from 10 to 40% below market value.

In a market like this, the ability to find and potentially acquire property at well below market value before other investors will give you a huge advantage.

For example:

There are an abundance of deals like this happening right now – if you know how to find them.